by Lauren Jackson | Jan 3, 2021 | Estate Planning, Joint Trust

In 2008, Congress recognized the need for the public to understand the importance and benefits of estate planning by passing House Resolution 1499, which designated the third week of October as National Estate Planning Awareness Week. Nevertheless, according to a 2019...

by Lauren Jackson | Oct 14, 2020 | Estate Planning, Life Insurnace, Real Estate

With a push by the Democratic party to return federal estate taxes to their historic norms, taxpayers need to act now before Congress passes legislation that could adversely impact their estates. Currently, the federal estate and gift tax exemption is set at $11.58...

by Lauren Jackson | Oct 6, 2020 | Estate Planning

Estate planning—it is an incredibly important tool, not just for the uber-wealthy or those thinking about retirement. On the contrary, estate planning is something every adult should do. Estate planning can help you accomplish any number of goals, including appointing...

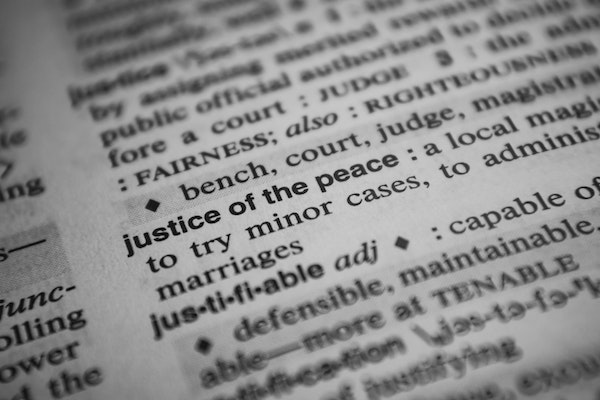

by Lauren Jackson | Sep 8, 2020 | Estate Planning, Medicaid

A popular question that I answer a lot for my estate planning clients is what is the Medicaid look-back period for assets? When clients realize they might be eligible for Medicaid, they start their estate planning with that in mind. However, the timing of everything...

by Lauren Jackson | Jun 28, 2020 | Estate Planning, Life Insurnace

One question that I continually hear from clients, friends, and family is what type of life insurance should I get? First off, let’s acknowledge that I am not an insurance salesperson and I do not and have never sold insurance. The following information is...

by Lauren Jackson | Apr 25, 2020 | Estate Planning, Joint Trust

News about the coronavirus is everywhere, and we have all been affected by it in some way, even if we are currently completely healthy. Although it may seem as though circumstances are spinning beyond our control, we are not powerless. There are steps we can take to...