by Lauren Jackson | Feb 15, 2024 | Attorney, Beneficiaries, Estate Planning, Lawyer, Living will, Power of Attorney, Retirement, Revocable living trust, Trusts, Wills

Whether you want to think about it or not, there comes a time in everyone’s life when it is too late to complete an estate plan. Waiting until the last minute, or until a significant life event occurs, can lead to complications and potential limitations. Being an...

by Lauren Jackson | Jan 12, 2024 | Attorney, Beneficiaries, Estate Planning, executor, Irrevocable trust, Lawyer, Revocable living trust, Trusts, Wills

Throughout the years, we have helped clients who believed that they were not getting their fair share of an estate or their family’s personal belongings. Unfortunately, even dealing with family, sometimes especially when dealing with family, when money or...

by Lauren Jackson | Dec 2, 2023 | Attorney, Billing, Estate Planning, executor, Lawyer, Small Business, Trusts, Wills

As more AI is developed, there will be more web-based companies that you can choose to help you draft your estate plan. Online companies will make promises to lure you in with convenience or an upfront cost that might seem too good to be true. Let’s review why...

by Lauren Jackson | Apr 10, 2022 | Estate Planning, Revocable living trust, Wills

As society becomes more digital, all our personal information and even some possessions are stored on the internet. Everyone seems to have email accounts, photos, social media accounts, and cloud storage just to name a few, but the list can be endless. To...

by Lauren Jackson | Oct 20, 2021 | Estate Planning, Joint Trust, Revocable living trust, Trusts, Wills

In 2008, Congress recognized the need for the public to understand the importance and benefits of estate planning by passing House Resolution 1499, which designated the third week of October as National Estate Planning Awareness Week. Nevertheless, according to a 2021...

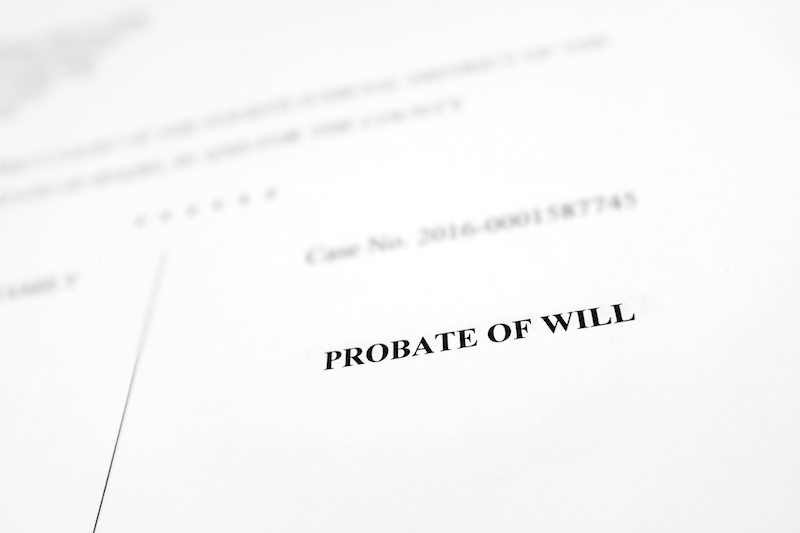

by Lauren Jackson | Jul 12, 2018 | Estate Planning, Probate, Wills

In the estate-planning world, there are many different requirements (depending on the state) for a last will and testament to be valid. One of the main reasons to make a Will is for it to set forth the final distribution of your assets. There is no point in having a...